samdiesel/E+ via Getty Images

There is one word at the moment that best describes the economy and the markets, with the major indices at all-time highs in my mind right now. And this word is unstable. Stocks have continued to rise despite the economy slowing growth from 4.9% in the third quarter of last year, to 3.4% in the fourth quarter and 1.3% in the first quarter of this year. Also, GDP growth estimates have fallen over the last month for second quarter growth.

GDP Now

The chart below provides a useful graphical depiction of how stocks are decoupled from the economy. As you can see, we are easily surpassing the extreme metrics that existed just before the Internet Boom turned into the Internet Bust at the turn of the century. The bursting of the bubble caused an over 80% drop in the NASDAQ until that index bottomed out in 2002 and saw the S&P 500 halve as well.

Goldman Sachs Global Investment Research/Zero Hedge

NVIDIA Corporation (NVDA) has replaced Cisco Systems (CSCO) As for the poster for this period of ‘irrational excitement’ nearly a quarter of a century later, as the AI revolution is the biggest paradigm shift for economics since the birth of the widespread internet in the 90s. This AI juggernaut is now the second most valuable company in the market with a market capitalization of over $3 trillion and now accounts for 6.5% of the total market cap of the entire S&P 500. NVIDIA has become over $1 trillion larger than all energy companies in the index, incl Exxon Mobil (XOM) AND Chevron (CVX) and its market cap is almost the size of the UK’s GDP. NVDA has also gained more than $1 trillion in market cap in less than 35 trading days, which is about the only thing growing at a faster rate than the federal debt.

Looking for Alpha

NVIDIA is a major contributor to bad market breadth. Last week, the NASDAQ posted a 2.4% gain while the small-cap Russell 2000 was up just over one percent on the market. So far in 2024, the NASDAQ is up nearly 16% while the Invesco S&P 500® Equal Weight ETF (RSP) is up just under five percent for the year, and the Russell 2000 is just barely in the black in 2024.

Let’s do a valuation exercise to show how extreme valuations have become by looking at the S&P 500’s gains before the Federal Reserve begins raising rates in mid-March 2022 compared to the last four quarters of performance.

S&P 500 Earnings by Quarter

Q2 2021: $48.39

Q3 2021: $49.59

Q4 2021: $53.94

Q1 2022: $45.99

Q2 2023: $48.58

Q3 2023: $47.65

Q4 2023: $47.79

Q1 2024: At $53.00 with some companies left to report

We’ll throw in a few more key data points to compare the two periods.

Fed funds rate YE21: 0% to .25%

Currently: 5.25% to 5.50%

National Debt YE21: $28.4T

Currently: $34.6 T

S&P 500 YE21: 4,766

Currently: 5,432

NASDAQ YE21: 15,180

Currently: 17,655

The bottom line is that investors are paying much higher earnings multiples at these levels now with the Fed Funds rate 525 bps higher than they were at the end of 2021 when we were still in a ZIRP environment.

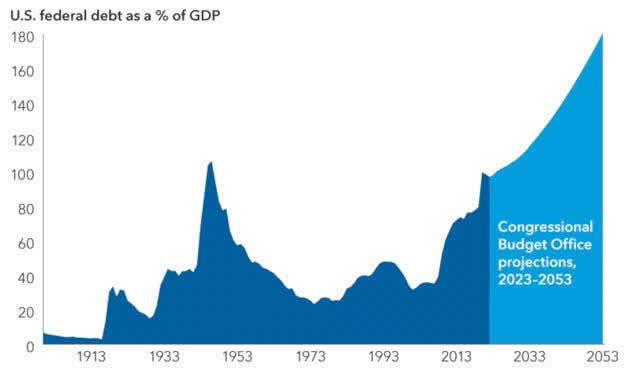

Then we have the Federal Debt, which has grown by more than $6 trillion since the end of 2021. And despite being in an economic expansion, the US is still seeing deficit spending of six to seven percent of GDP in annual basis. This has affected economic growth, but also inflation.

FY2019 Federal Budget (Congressional Budget Office)

The large budget gap is almost entirely due to increased spending. In FY2019, the federal government took in $3.5 trillion in revenue and had $4.4 trillion in spending. In FY2023, federal government spending had risen to $6.13 billion even as revenues continued to grow at a more modest rate to $4.71 trillion. With interest due to service the debt at a rate already over $1 trillion at current interest rates and the debt-to-GDP ratio already at the highest level in US history, this is clearly unsustainable.

CBO/Capital Economics

Not to look a gift horse in the mouth, as everyone enjoys a rally, but the market appears to be pricing in perfection with the S&P 500 approaching a valuation of 22 times forward earnings. The brokered war with nuclear-armed Russia in Ukraine appears to be escalating at a rapid pace (and getting little media attention), and commercial real estate, or CRE, continues to deteriorate.

May CMBS delinquency rate by property type (Trepp)

Furthermore, the consumer has spent all excess savings from all the Covid stimulus and has personal savings rates less than half the pre-pandemic rate, the May BLS jobs number last Friday was a joke (positions full-time jobs took a hit while part-time positions rose 286,000), we have a brutal and divisive election on the horizon (and based on the results in Europe this weekend, perhaps a seismic shift in the outcome), economic growth has slowed significantly by half late 2023, valuations at regional banks are being cut, there is little apparent insider buying in stocks, etc.

Excess Personal Savings in the US (Bureaus of Economic Analysis)

I know the market is supposed to grow an’the wall of worryand that in the near future we’ll all be skinny thanks to GLP-1 weight loss drugs and have AI-powered robotic servants, but this future utopia seems fully priced in the market.

Therefore, I remain very cautious about my portfolio composition. On Wednesday, I added some funds to my short-term treasury funds, yielding over 5.3%. Short-term Treasuries now make up roughly half of my portfolio, with covered call holdings making up almost all of the rest. I also executed some small orders for some of the money, the old bear put sperde against SPDR® S&P 500® ETF Trust (SPY), just in case Nirvana doesn’t materialize in the coming year. I see this as cheap portfolio insurance in a very uncertain and volatile market.

#Volatile #word #describe #economy #markets

Image Source : seekingalpha.com